Blockchain's "GENIUS Act" Moment: How Stablecoin Regulation is Unlocking Crypto's Next Trillion-Dollar Wave

The Ground is Shifting: Regulation Meets Reality

Remember the early days of the internet? It was wild, chaotic, full of potential, but also rife with scams and uncertainty. It took years of policy debates, regulatory frameworks, and, frankly, a lot of trial and error to get to where we are today. Well, crypto is having its "internet moment," and I think we’re finally seeing the pieces fall into place.

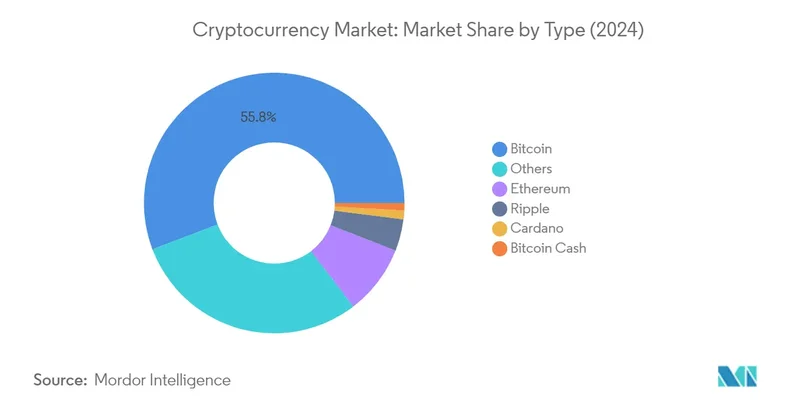

The big story? Stablecoins. I know, I know, it doesn't sound as sexy as "DeFi revolution" or "NFT mania," but trust me, this is where the real action is. We're talking about digital assets pegged to stable currencies like the US dollar or the Euro. They're designed to be, well, stable, making them ideal for everyday transactions, cross-border payments, and a whole host of other applications that could revolutionize the way we interact with money.

And guess what? Regulators are finally starting to get it. The TRM Labs report noting that over 70% of jurisdictions are progressing stablecoin regulation in 2025 isn’t just a statistic; it's a signal that the old guard is waking up to the potential of this technology. Think of it like the invention of the printing press. Before Gutenberg, information was controlled by a select few. The printing press democratized knowledge, making it accessible to the masses. Stablecoins, with proper regulation, can do the same for finance, empowering individuals and businesses with unprecedented access to a global, open, and transparent financial system.

I’m particularly excited about the US’s GENIUS Act. It might sound like a cheesy name, but it represents a huge step forward in providing the regulatory clarity that institutions have been craving. It's not just about ticking boxes and complying with rules; it's about creating a level playing field where innovation can thrive and where consumers are protected from fraud and abuse.

Now, I know some of you are probably thinking, "Regulation? That sounds boring and restrictive!" And I get it. But here’s the thing: regulation, when done right, can actually fuel innovation. It provides the guardrails that allow institutions to participate with confidence, unlocking massive amounts of capital and expertise. As the report highlights, about 80% of reviewed jurisdictions saw financial institutions announce digital asset initiatives in 2025. That's not a coincidence. That's the sound of smart money moving into the space, driven by the promise of clear, consistent rules.

But let’s be clear, this isn’t just about big banks and hedge funds. This is about creating a more inclusive financial system for everyone. Imagine a world where small businesses can access capital without jumping through hoops, where remittances can be sent across borders instantly and at virtually no cost, where individuals can control their own financial data and participate in a truly decentralized economy.

And Texas becoming the first US state to publicly invest in Bitcoin? That's not just a symbolic move, it's a statement. It's a signal that even traditionally conservative institutions are starting to see the writing on the wall: crypto is here to stay, and it's time to get on board.

Of course, there are challenges ahead. We need to ensure that regulation doesn't stifle innovation, that it's flexible enough to adapt to the rapidly evolving landscape of crypto. We need to address concerns about illicit finance and ensure that these technologies are not used to launder money or fund terrorism. And we need to be mindful of the potential impact on monetary policy and financial stability.

But these are challenges we can overcome. We have the talent, the technology, and, increasingly, the political will to build a better financial future. When I first read about Basel Committee reassessing the strict capital rules for banks' crypto exposures, I just knew the space was maturing.

And let's not forget the importance of global consistency. As the FATF has warned, gaps in standards implementation create vulnerabilities that can be exploited by bad actors. We need to work together to create a level playing field where everyone plays by the same rules, preventing regulatory arbitrage and ensuring that the benefits of crypto are shared by all.

There's a comment I saw on a Reddit thread the other day that really stuck with me: "Regulation isn't the opposite of decentralization, it's the foundation for its responsible growth." I couldn't agree more.

The Future is Being Written, One Line of Code at a Time

So, what does this all mean? It means that crypto is finally growing up. It means that the wild west days are coming to an end, and that a new era of responsible innovation is dawning. It means that the dream of a more inclusive, accessible, and transparent financial system is within reach. It's the kind of breakthrough that reminds me why I got into this field in the first place. Let's build it together.